Everything you need to know about Divorce & Real Estate

Everything you need to know about Divorce & Real Estate

As a divorcee myself, I would like to start with words of encouragement that this too shall pass. I remember feeling embarrassed, ashamed, disgraced, and like I failed. Very few people were in my corner or stood by my side. On the other side of the divorce, you will find a better version of yourself. A wiser, empathetic, patient, kinder, graceful version of yourself that you were and want to be.

However, we have some work to do today regarding your financial assets. One of the largest is real estate. It could be commercial, residential, or land but it all must be dealt with just the same. In this article you will find everything you need to know about Divorce and Real Estate. If there is a topic I missed or if you would like to ask additional questions please inquire with me at avarela@neighborhoodloans.com, Subject of the Email: Everything you need to know about Divorce & Real Estate.

Where do I start?

There are few specialists in the mortgage industry or in the real estate industry that hold a special designation entitled Real Estate Collaboration Specialist- Divorce or RCS-D Designation. These are trained professionals that help divorcing homeowners make an informed decision about keeping the house and their eligibility for buying a home in the future. They also help clients protect heir credit score even if they do not currently own real estate. I am a RCS-D and you are welcome to reach out to me for free guidance regarding divorce and real estate.

Gathering Documents

Let’s say you want to get started on your own. First step is to gather all the necessary documents regarding your real estate purchases. The List includes the following:

- 1st & 2nd Lien Documents

- Uniform Residential Loan Application

- Truth In Lending Disclosure/Loan Estimate

- HUD1 Settlement Statement/Closing Disclosure

- Mortgage payoff

- Mortgage Note

- Title Search

- Lien Search

- Legal Description

- Deed/Deed of Trust

- HOA status letter

- Marital Balance Sheet – often provided by your attorney or by a financial advisor to list all assets you and your current spouse own.

Each document tells a different story. Your attorney and financial advisor will require some or all these documents, so it is good to get a head start.

How much is the home worth?

You may be offered a Comparative Market Analysis (CMA) by a Realtor, A Broker Price Opinion (BPO), or an Automated Valuation Model to obtain the value of your home. However, the only document that will hold up in court is an official Appraisal Report from a licensed appraiser. You can click, find Appraiser, to help you find a licensed appraiser anywhere in the United States. If you would like a referral for somebody that we do business with and is trusted, please email me at avarela@neighborhoodloans.com subject line: Trusted Appraiser. An appraisal will assess the value of your home based on the most recent sales comparisons within a 1-mile radius of your home and within the last 6 months. You also want to get a home inspection to document and value any deferred maintenance on the home and any major issues on the home that may impact the value of the home. All of which can be negotiated thru the divorce. The true value of a home is what would it cost to get it ready to put the home on the market to sell and what is the fair market value somebody is willing to pay for the home in this market?

What goes wrong with a mortgage during a divorce?

During a divorce we see a lot of financial issues arise. One spouse does not pay a bill or refuses to pay a bill. There can also be joint deb left over after the divorce. It may be awarded to one party or another but still jointly held on both credit accounts. Sometimes, the spouse will not be able to refinance the house that is awarded to them after the divorce. It could be credit or lack of income. We also see a lot of confusion as to how things will be handled during the divorce proceedings and after the divorce is finalized. Qualifying to refinance the home can be tricky if you are the spouse that has not been the bread winner or if you have exited the workforce while being married. Income source, credit history, and current liquid assets are all factors that are used in qualifying you for a home loan. For example: the spouse that has stayed at home with the kids for the past ten years now finds themselves in a position to provide for the family and return to work. How long do I have to be back at work before you can use my income? How many months of alimony or spousal support do I need to document before it is considered income? We can help with all of these hurdles if you will please reach out for help at avarela@neighborhoodloans.com.

Warnings: Secured Debt, HELOCs, Scams

A spouse can conceal debt and you may be liable for it during the divorce. Most debt that is taken out during the marriage belongs to both spouses regardless of if it was borrowed with your knowledge or not. Now, there is criminal debt that is obtained by forging the other spouse’s signature and using their identity without their knowledge, but this is handled differently of course. We have seen a spouse use a HELOC or spend money abruptly before the divorce is discharged to make a personal financial gain or to simply get revenge or hurt the other spouse financially. Be cautious to do all your due diligence before the divorce is finalized. A good idea would be to obtain a credit report for each spouse to make sure that all debt is disclosed.

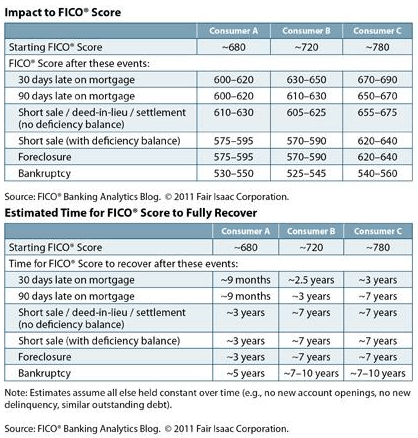

Mortgage Delinquency Impact on FICO Score

A mortgage late payment can ruin your credit in the short term. Below is a chart and resource to measure the impact of each major derogatory item that can happen with your mortgage. There are solutions and ways out of a mortgage. Please consult a mortgage professional or a realtor asap. You are always welcome to email

avarela@neighborhoodloans.com subject line Divorce Help for immediate assistance.

Wrap it all up:

There are a lot of moving parts when it comes to a divorce. The best practice is to consult a professional that has the experience and knowledge required to help you navigate the situation. It is also, helpful to work with somebody that has been through it themselves as they know exactly what you are dealing with. Please contact me for support and help through this stressful time.

Alexander J. Varela RCS-D

SVP Regional Manager

Neighborhood Loans, Inc

SHARE

WHY TEAM VARELA

12 Loans = 1 Life

Freeing Youth From Sex Trafficking

For every 12 transactions closed with Team Varela, Traffic 911 identifies 1 victim and assists law enforcement with prosecution of their perpetrator(s) with detailed investigation and reporting.

Dallas-based Mortgages

Family-first Approach

Whether you’re a first-time homebuyer, need downpayment assistance, are looking for a renovation loan, or even a jumbo loan, Team Varela in Dallas, TX is committed to a family-first approach. Team Varela invests in families.

Site Thoughtfully Designed By Stream Now Creative